If you're already planning for future college costs, you've overcome the biggest obstacle: getting started.

Rising tuition, unpredictable market returns, and tight budgets often scare parents into inaction. But once you put a plan in place, you'll find everything is much more manageable.

Here's how you can overcome the top 3 savings challenges and meet your goals:

Challenge 1: Rising tuition

Challenge 1: Rising tuition

The situation: College tuition is rising, but at a slower pace. Between 2013-14 and 2023-24, the average published in-state tuition and fees at public 4-year institutions declined by 4% after adjusting for inflation, compared with increases of 44% between 1993-94 and 2003-04 and 51% between 2003-04 and 2013-14.*

The solution: Start today and invest as much as you feel comfortable with. You can't control tuition prices, but you can control how much you save from now until your child starts school. Plus, earning compound interest on your savings may help offset tuition increases.

If your child is getting older, and closer to high school graduation, you may feel like it's too late. But saving now can still make a difference.

Here's a hypothetical example:

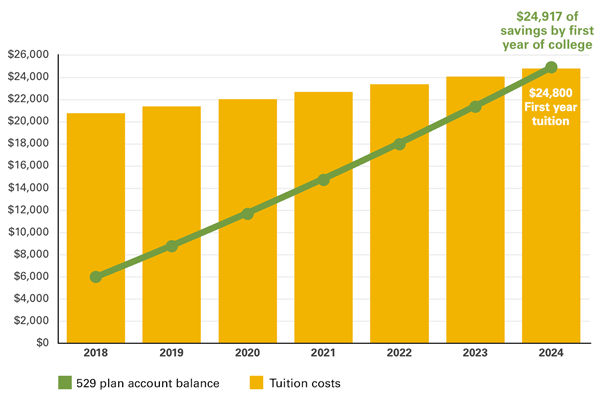

Emma's parents have saved a total of $6,000 in a 529 plan account for her education. Now that she's in middle school, they're more serious about building up that account. They decide to invest $200 a month toward her tuition at an in-state public college.

Over the next 6 years, Emma's account earns a 5% average return, giving her almost $25,000. Even with 3% annual tuition hikes, that's enough to pay for Emma's first year of school. In total, her 529 account adds up to about 25% of Emma's 4-year tuition costs.

*Calculated using the Bankrate compound interest calculator

This hypothetical illustration (or “example”) does not represent the return on any particular investment and the rate is not guaranteed.

While 25% might not sound like a lot, Emma is ahead of most students.

Challenge 2: Unpredictable market returns

Challenge 2: Unpredictable market returns

The situation: Over the past 10 years, the stock market has been bullish overall, but few economists expect that to continue*, creating an investing dilemma: You want to stay ahead of rising tuition costs, but you also want the money available when you need it.

The solution: Consider investing strategically in a diversified portfolio. In most 529 plans, you can choose an age-based option, which shifts your investments automatically. Similar to target-based retirement funds, age-based options are designed specifically to help you invest for college. These funds move your investments from aggressive to conservative mutual funds as your child gets older.

If you want more control over your investments, you can choose to make these investment shifts yourself, maximizing your chances of high returns while minimizing the risk of losing your savings when you need it most.

Challenge 3: Saving on a tight budget

Challenge 3: Saving on a tight budget

The situation: If you're like many families saving for college, your household expenses compete with your savings goals. Contributing $150–$200 monthly to your 529 account seems unrealistic. After all, you still need to save for retirement and pay your bills.

The solution: Ask family members and friends to consider contributing to your 529 account on special occasions. Small gifts can add up to thousands of dollars over the years. Many plans allow you to create a code that makes it easy for others to deposit money directly into your account. Graduations—from kindergarten through high school—are a natural time for family and friends to add to your child's savings.

As an added bonus, you might be eligible for a state tax deduction. More than 30 states offer full or partial state tax deductions for 529 plan contributions. But don't wait until tax time—you'll need to invest in your 529 account by the end of each calendar year to take advantage of the benefits.

Calculate your state's tax deduction

For most people, there's no easy way to save 100% of college costs. That's why it's important to set realistic goals. Every dollar you save now will make a difference in your child's future.