As your student prepares to leave for college or to take higher-education courses this fall, it's time to start making withdrawals from your 529 plan account. There are a few things you can do right away to get ready for those incoming college bills.

First, be proud of yourself for saving for your student's future. You've already done the hard part! Higher education is expensive and your contributions to the plan over the years will make a difference.

Next, follow these 3 steps so you're prepared to make your first withdrawal:

1. Establish banking instructions

If you haven't already, consider setting up bank information for your 529 account so you can make online withdrawals. It's simple and only takes a few minutes.

Log on to your 529 account, then:

- From My Accounts, choose the appropriate beneficiary's account.

- From the right-hand navigation, select View Profile & Documents.

- From the left-hand navigation, choose Bank Information.

- Select Add a New Bank and follow the instructions.

2. Check your asset mix

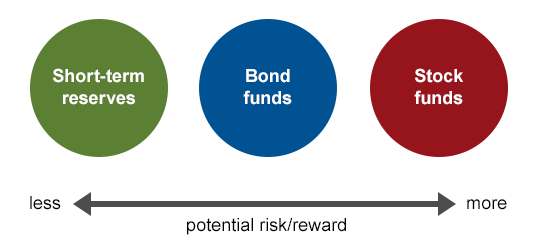

If you're invested in an age-based option, your savings has been automatically shifting to a more conservative asset allocation as your child has moved closer to college age.

However, if you're invested in one or more of your plan's individual portfolios, you may want to check your current asset mix. Many investors with college-age beneficiaries choose more conservative investments, such as bonds and short-term reserves, rather than stocks, as a way of preserving principal and reducing risk.

If you haven’t reviewed your asset allocation for a few years or are not sure what mix is best for you, we created a tool to help.

Determine your asset allocation

For more information about how to determine your asset allocation and to rebalance your mix, you may want to check out this article.

Read our asset allocation article

3. Determine the "right" withdrawal amount

Withdrawals from your 529 plan account are tax-free as long as they're used to pay qualified higher-education expenses. These expenses include tuition, room and board, fees, books, supplies, and computers and related equipment.

Be careful not to withdraw too much—any amount over what you use to pay for qualified higher-education expenses must be reported as taxable income by either you or the beneficiary, depending on who receives the withdrawal.

The earnings portion of any nonqualified withdrawal may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

How to make a withdrawal

Once you're ready to start paying your higher-education bills, you can make withdrawals from your account online, by mail, or by phone.